Our Approach to Detailed Insurance Verification

In the realm of detailed insurance verification, our team employs a systematic methodology that prioritizes thoroughness and accuracy. We understand that effective insurance verification is essential for ensuring that claims processing is conducted seamlessly. To achieve this, we utilize a combination of advanced tools and industry best practices. Our approach starts with a comprehensive data collection process, where we gather all relevant documentation from both the insurer and the insured parties. This initial step allows us to establish a solid foundation for the verification procedure.

Our team leverages cutting-edge technology to streamline the verification process. This includes utilizing specialized software that automates data entry and cross-checking against established criteria. By harnessing these tools, we significantly reduce the risk of human error, which is often a common challenge in manual verification processes. Furthermore, our team is trained to execute a meticulous review of each insurance policy, ensuring that all details, including coverage limits, exclusions, and conditions, are accurately assessed.

While we strive for precision, we also recognize the importance of client engagement in this process. Our proactive approach involves regular communication with clients, providing updates on verification status and addressing any concerns that may arise. This transparency fosters trust and enhances client satisfaction, as they are kept informed every step of the way. Throughout our work, we have encountered challenges, such as discrepancies in provided documentation. However, our thorough investigation and collaboration with all stakeholders allow us to resolve these issues efficiently.

Ultimately, our commitment to detailed insurance verification not only minimizes errors but also instills confidence in our clients, reinforcing our reputation as a trusted partner in their insurance needs. Our methodologies are designed to ensure that the verification process is both efficient and reliable, setting the stage for successful outcomes in the insurance domain.

Showcasing Our Achievements: Evidence of Success

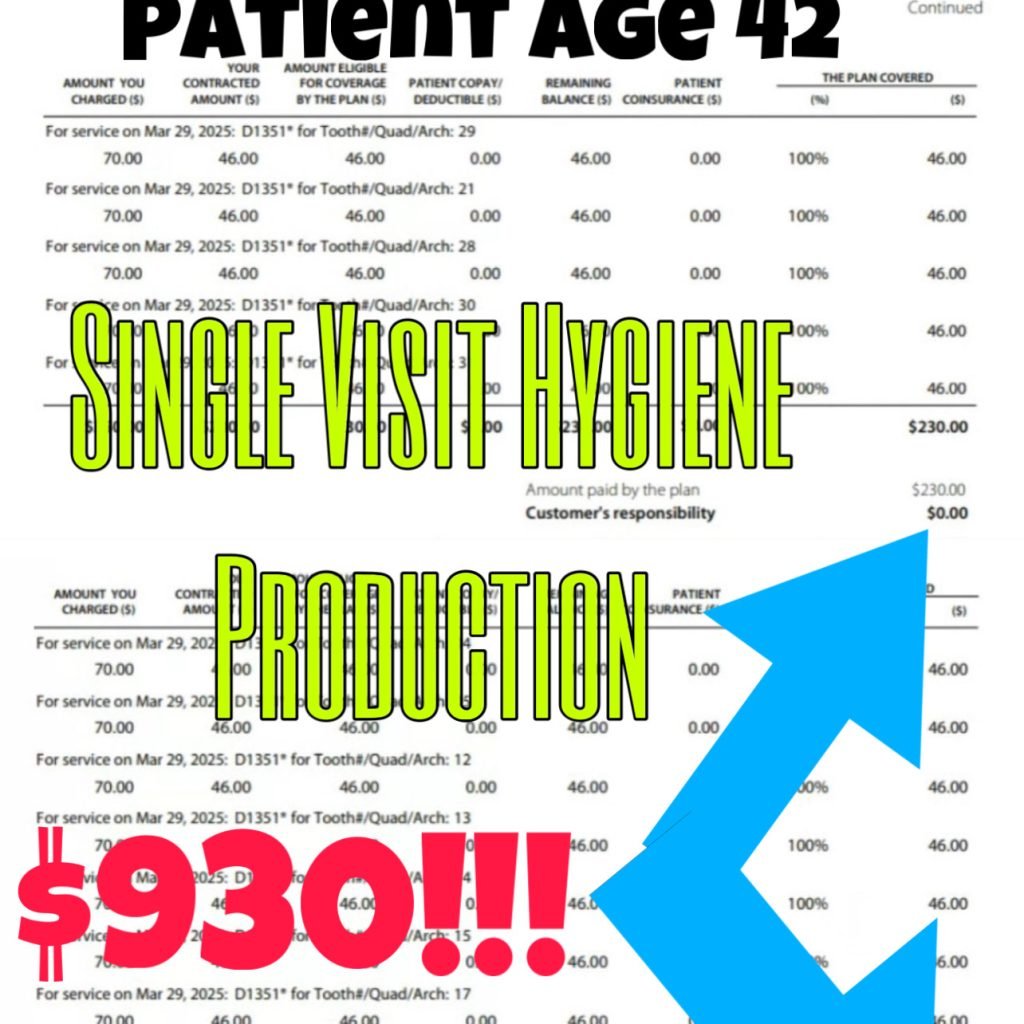

In the realm of detailed insurance verification, our team’s recent achievements have been marked by a series of successful outcomes, each supported by Evidence of Benefit (EOB) documents that attest to our diligent efforts. Collectively, these documents present a robust overview of our capabilities and highlight the significant impacts we have made for our clients.

Firstly, the EOB pertaining to Client A illustrates how our meticulous verification processes identified discrepancies that, when rectified, saved the client over $50,000 in potential claims that would have otherwise been wrongly processed. Our attention to detail ensured that the claims were aligned with the actual services rendered, cementing client trust in our verification methodologies.

In another case, the EOB for Client B underscores the speed of our verification process. Here, expedited insurance confirmations allowed the client to initiate treatments without delay, significantly enhancing patient satisfaction. The documented turnaround time of just 48 hours showcases our commitment to not only accuracy but also efficiency in service delivery.

Client C’s EOB highlights an instance where our proactive approach uncovered billing errors that had the potential to lead to claims denials. By resolving these issues preemptively, we reinforced the financial stability of our client’s operations. Such outcomes reflect our emphasis on thoroughness and meticulousness in the verification process.

Additionally, the series of EOBs also includes positive feedback from clients regarding our comprehensive reporting capabilities. Each EOB serves as evidence of our ability to deliver insightful data that aids clients in strategizing their financial management and resource allocation effectively.

Our achievements documented through these EOBs are a testament to our unwavering dedication to excellence in detailed insurance verification. This commitment not only leads to cost savings and operational efficiency for our clients but also fortifies our reputation as leaders in the industry.

Future Goals and Continuous Improvement

As we reflect on our recent successes in insurance verification, it is essential to establish a clear vision for our future. Our commitment to enhancing our services continues unabated, driven by a relentless pursuit of excellence. In the coming period, we aim to implement ongoing training initiatives for our team members, ensuring they remain well-versed in the latest industry standards and practices. This focus on training not only bolsters individual competencies but also enhances our collective capacity to deliver top-tier insurance verification services.

In addition to training, we recognize the critical role that technology plays in streamlining our processes and improving efficiency. We are currently exploring the integration of advanced analytics and machine learning tools that can assist in automating various aspects of insurance verification. By harnessing these technological advancements, we aspire to reduce turnaround times, minimize errors, and ultimately enhance the customer experience. Our goal is not just to keep pace with technological evolution but to lead the way in operational innovation within the insurance sector.

Moreover, we will continuously align our strategic foci with emerging trends and evolving consumer expectations. Monitoring regulatory changes and industry benchmarks will enable us to refine our goals effectively. By committing to regular assessments of our performance against such benchmarks, we aim to ensure that our insurance verification services not only meet current demands but also anticipate future needs. This proactive approach will position us as industry leaders and guardians of best practices within the realm of insurance verification.

In conclusion, our future aspirations are clear. Through persistent training, the incorporation of cutting-edge technology, and an unwavering commitment to aligning with industry standards, we aim to elevate our insurance verification services. By setting new benchmarks and continuously improving, we are confident that our achievements can be sustained and further enhanced as we look ahead.