Understanding Insurance Verification

Insurance verification is a critical component in the healthcare industry, particularly within the realm of orthodontics. This process involves confirming a patient’s insurance coverage details and benefits prior to the delivery of services. In orthodontics, where treatment can span several months to years, understanding insurance coverage for orthodontic procedures is essential for both providers and patients. A detailed verification process allows orthodontic practices to gain insight into the specific benefits available to their patients, including any limitations, exclusions, and the appropriateness of their coverage for various treatments.

For orthodontic providers, the implications of thorough insurance verification are significant. When practices confirm the details of their patients’ plans, they can strategically design treatment plans that align with available benefits. This not only fosters clearer communication with patients but also enhances the likelihood of receiving appropriate reimbursement for services rendered. By identifying the extent of the patient’s orthodontic coverage upfront, providers can effectively manage financial expectations, thus minimizing confusion or dissatisfaction that may arise later in the treatment process.

Moreover, understanding the insurance landscape is not merely beneficial for patients; it can also substantially impact practice revenue. Orthodontic practices that prioritize a comprehensive verification process are better equipped to avoid under-coding or billing errors that can lead to denied claims. By optimizing the collection of benefits through thorough insurance verification, these practices can enhance their financial performance and promote patient satisfaction simultaneously. In this way, insurance verification acts as a critical step in maximizing insurance benefits for orthodontic treatments, ensuring that patients receive the care they need while safeguarding the economic viability of the practice.

Orthodontic Coverage Beyond Typical Age Limits

In the realm of orthodontic treatments, a prevailing misconception persists regarding coverage limitations tied to age. Commonly, individuals believe that orthodontic insurance benefits cease once they reach the age of 19 or 26. However, a significant number of insurance providers extend orthodontic coverage to adults, thus broadening access to essential dental care beyond these conventional age thresholds. This extension represents a critical opportunity for both patients and healthcare providers to rethink the approach to adult orthodontics.

Many adults are unaware that their insurance plans may indeed encompass orthodontic treatment costs. This misunderstanding can dissuade individuals from pursuing necessary orthodontic interventions, leading to prolonged dental issues that could have been mitigated through early or timely treatment. Insurance policies vary widely, and some may offer comprehensive orthodontic benefits regardless of a person’s age, especially in cases deemed medically necessary. As such, it is crucial for healthcare providers to familiarize themselves with the specifics of coverage available through various insurance plans.

Consider, for instance, a case study involving an adult patient named Sarah, who believed her age rendered her ineligible for ortho coverage. Upon reassessment of her dental insurance policy, it was discovered that her plan provided extensive benefits for adult orthodontics in cases where structural dental issues were present. This not only empowered Sarah to address her orthodontic needs but also illustrates the importance of consulting with insurance providers to uncover potential benefits.

Moreover, practices that actively educate their patients about the possibilities of orthodontic coverage can foster a more proactive attitude towards dental health. By highlighting the options available for adult patients, healthcare providers can inspire confidence and promote the pursuit of effective treatment plans that may have initially been overlooked due to age misconceptions.

Leveraging EOBs for Patient Engagement

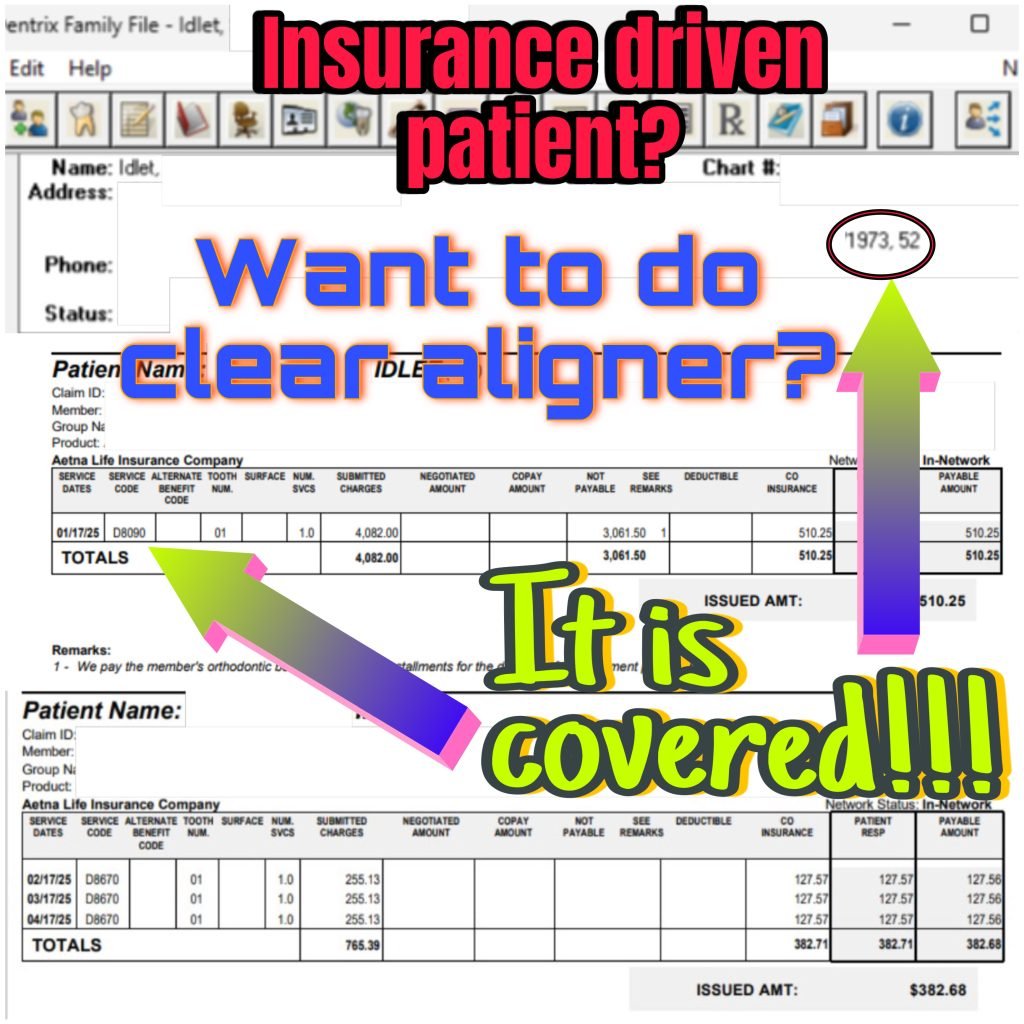

In the realm of orthodontic treatments, effectively utilizing Explanation of Benefits (EOBs) can significantly enhance patient engagement. EOBs serve as crucial documents that break down the financial aspects of insurance claims, translating complex insurance jargon into understandable terms for patients. By sharing these statements with patients, dental practices can foster greater understanding and acceptance of treatment plans, leading to improved approval rates.

To optimize patient engagement, clinics should ensure that EOBs are shared promptly after services are rendered. When patients receive this information in a timely manner, it provides them with clarity regarding what their insurance will cover and what they may need to pay out-of-pocket. It is beneficial for orthodontic practices to take the time to explain each section of the EOB, identifying coverage limits, co-pays, and any remaining balances. This transparency helps patients to prepare financially for their treatment journey.

Moreover, practices can adopt various strategies to communicate effectively the financial implications of orthodontic treatments. For example, accompanying the EOB with a personalized letter can reinforce understanding. This letter could outline the anticipated costs, any discrepancies between patient expectations and actual insurance benefits, and offer suggestions for payment plans if necessary. Additionally, practices may organize informational sessions or workshops focused on insurance literacy, helping patients understand the intricacies of their insurance policies and EOBs.

By leveraging EOBs strategically, dental practices can not only improve transparency but also foster trust with their patients. Engaging patients in discussions around financial obligations creates a more collaborative environment, allowing them to feel more empowered when making decisions regarding their orthodontic care. This proactive approach can ultimately lead to higher patient satisfaction and increased acceptance of treatment plans.

The Role of Dental Professionals in Business Growth

Licensed dentists and their teams play an essential role in the success of any dental practice, particularly in the realm of orthodontic treatments. While the primary focus remains on patient care and improving oral health, the business side of dentistry is equally crucial. A business-minded approach that prioritizes maximizing production and collections can significantly enhance a practice’s financial health and sustainability.

To effectively implement this approach, dental professionals must align clinical excellence with sound business strategies. One of the first steps is focusing on patient education. By thoroughly explaining treatment options and the financial benefits of orthodontic care, dental teams can foster trust and encourage patients to pursue necessary treatments. Education empowers patients, enabling them to make informed decisions regarding their oral health—resulting in increased treatment acceptance rates.

Insurance verification also plays a pivotal role in transforming a practice’s efficiency and profitability. By verifying coverage before starting treatment, dental teams can avoid delays and misunderstandings related to billing. This proactive step not only expedites the process but also enhances patient satisfaction by clarifying financial responsibilities up front.

Moreover, how treatment plans are presented can greatly influence patient engagement. Clear and structured explanations, combined with detailed cost breakdowns, can demystify the financial aspects of orthodontic treatments. Utilizing visual aids or digital tools during presentations can further enhance comprehension and acceptance. The integration of effective communication, patient education, and streamlined financial processes equips dental professionals with the tools necessary to boost practice growth.

In summary, by adopting a business-oriented perspective, dental practitioners not only improve patient outcomes but also foster a thriving practice. The interplay between clinical and financial strategies creates a sustainable environment where patient satisfaction and economic success can flourish simultaneously.